To help you navigate this process, we have created this step-by-step guide on how to register a business in California. We will cover the following steps:

If you have a great business idea and want to turn it into reality, one of the first steps you need to take is to register your business with the appropriate authorities. Registering your business is not only a legal requirement, but also a way to protect your business name, establish your legal identity, and obtain the necessary licenses and permits to operate your business.

However, registering a business in California can be a complex and confusing process, especially if you are not familiar with the rules and regulations of the state and local governments. There are different types of business entities, names, licenses, permits, and taxes that you need to consider and comply with.

By following these steps, you will be able to register your business in California and start your entrepreneurial journey. Let’s get started!

1: Choose a Business Entity

The first step to register your business in California is to choose a business entity. A business entity is the legal structure that defines how your business is organized, operated, taxed, and liable. It also affects your personal assets, ownership rights, management control, and financing options.

There are different types of business entities available in California, such as:

- Sole proprietorship: A simple and common form of business where you are the sole owner and operator of your business. You have full control and responsibility over your business, but you also have unlimited personal liability for your business debts and obligations.

- Partnership: A form of business where two or more people agree to share the ownership and operation of a business. There are different types of partnerships, such as general partnerships, limited partnerships, and limited liability partnerships, which have different levels of liability and management rights for the partners.

- Corporation: A form of business where the business is a separate legal entity from its owners, who are called shareholders. A corporation has its own rights and obligations, and can sue and be sued, own and sell property, and enter into contracts. A corporation also provides limited liability protection for its shareholders, but it is subject to more regulations and taxes than other forms of business.

- Limited liability company (LLC): A form of business that combines the features of a corporation and a partnership. An LLC has one or more owners, who are called members, and can be managed by the members or by appointed managers. An LLC provides limited liability protection for its members, but it is more flexible and less complex than a corporation.

Each business entity has its own advantages and disadvantages, and you should consult a lawyer or an accountant before making a decision. You can also find more information and guidance on the California Secretary of State website.

2: Choose a Business Name

The second step to register your business in California is to choose a business name. A business name is the name under which you conduct your business activities, and it is also the name that your customers and clients will recognize and remember you by.

There are two types of business names that you need to consider: a legal name and a fictitious name.

- A legal name is the official name of your business entity, such as John Smith LLC or ABC Corporation. You need to register your legal name with the California Secretary of State when you form your business entity, such as an LLC or a corporation. If you operate as a sole proprietorship or a general partnership, your legal name is your own name or the names of the partners.

- A fictitious name is the name that you use to identify your business to the public, such as John’s Plumbing or ABC Consulting. You need to register your fictitious name with the county clerk’s office in the county where your business is located, if it is different from your legal name. This is also known as doing business as (DBA) or trade name registration.

You should also check the availability and protectability of your business name before registering it and can use the California Business Search tool to check if your desired name is already in use by another business entity in the state or use the U.S. Patent and Trademark Office (USPTO) website to check if your desired name is already trademarked by another business in the country. If you want to trademark your own name, you can apply for a federal or a state trademark registration.

Step 3: File Your Business Formation Documents

The third step to register your business in California is to file your business formation documents. These are the documents that officially create and register your business entity with the state government. The type and content of these documents vary depending on the business entity you choose.

For example, if you choose to form an LLC, you need to file a document called Articles of Organization with the California Secretary of State. This document contains information such as the name, address, purpose, duration, and management of your LLC. You also need to pay a filing fee of $70 and an annual tax of $800.

If you choose to form a corporation, you need to file a document called Articles of Incorporation with the California Secretary of State. This document contains information such as the name, address, purpose, stock, and directors of your corporation. You also need to pay a filing fee of $100 and an annual tax of $800.

You can find the forms and instructions for filing your business formation documents on the California Secretary of State website. You can also file your documents online using the BizFile California portal.

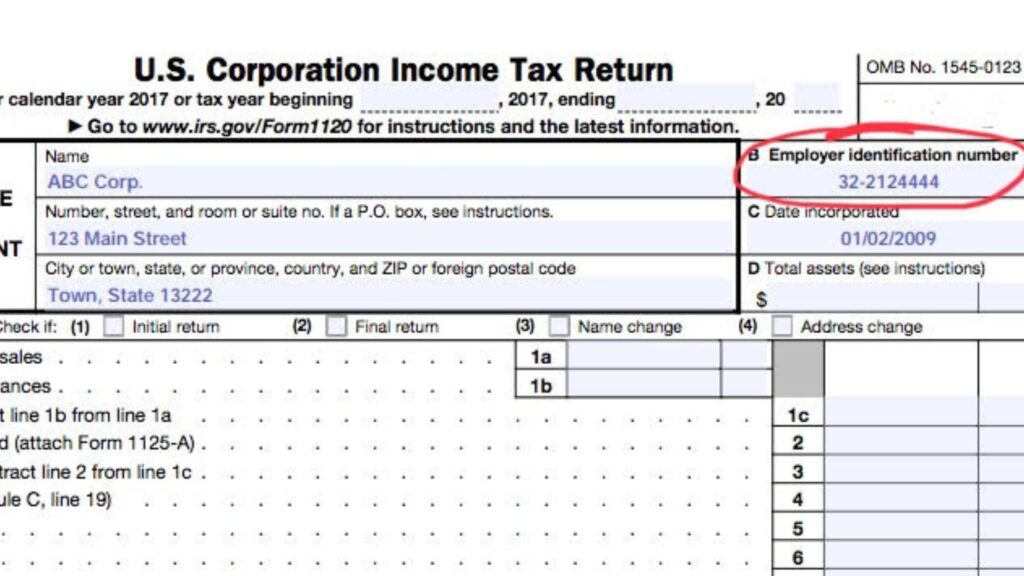

Step 4: Obtain Your Employer Identification Number To Register Business in California

The fourth step to register your business in California is to obtain your employer identification number (EIN). An EIN is a unique number that identifies your business entity for tax purposes. You need to apply for an EIN with the Internal Revenue Service (IRS) if you operate as a corporation, an LLC, a partnership, or a sole proprietorship with employees.

You can apply for an EIN online, by mail, by fax, or by phone. The online application is the fastest and easiest way to obtain your EIN, and you can get it immediately. The other methods may take several days or weeks to process your application.

You can find more information and guidance on how to apply for an EIN on the IRS website.

Step 5: Register for State and Local Taxes for a Business in California

The fifth step to register your business in California is to register for state and local taxes. These are the taxes that you need to file and pay to the state and local governments, based on the income, sales, payroll, and property of your business.

The types and requirements of state and local taxes vary depending on the nature, location, and size of your business. Some of the common state and local taxes that you may need to register for include:

- Income tax: A tax that you pay on the income or profit of your business. You need to file and pay your income tax with the IRS and the California Franchise Tax Board (FTB), according to the tax rates and schedules of your business entity and income level.

- Sales tax: A tax that you collect and pay on the sales of tangible goods or products in California. You need to register for a seller’s permit with the California Department of Tax and Fee Administration (CDTFA), and file and pay your sales tax with them, according to the tax rates and rules of the state and local jurisdictions where you sell your goods or products.

- Payroll tax: A tax that you withhold and pay on the wages and salaries of your employees. You need to register for an employer account with the California Employment Development Department (EDD), and file and pay your payroll tax with them, according to the tax rates and rules of the state and federal governments.

- Property tax: A tax that you pay on the value of the real and personal property that you own or use for your business. You need to register for a business property statement with the county assessor’s office where your property is located, and file and pay your property tax with the county tax collector’s office, according to the tax rates and rules of the county and local governments.

You can find more information and guidance on how to register for state and local taxes on the California Tax Service Center website. You can also contact the relevant state and local agencies for more information and assistance.

Step 6: Obtain Your Business Licenses and Permits

The sixth step to register your business in California is to obtain your business licenses and permits. These are the legal documents that authorize you to operate your business in compliance with the laws and regulations of the federal, state, and local governments.

The types and requirements of business licenses and permits vary depending on the nature, location, and size of your business. Some of the common business licenses and permits that you may need to obtain include:

- Business license: A general license that allows you to conduct business in a city or county. You need to apply for a business license with the city or county where your business is located or operates.

- Professional license: A license that certifies your qualifications and skills to provide certain professional services, such as accounting, law, medicine, or engineering. You need to apply for a professional license with the appropriate state board or agency that regulates your profession.

- Health and safety permit: A permit that ensures that your business meets the health and safety standards and codes of the state and local authorities.

If you’re considering starting a business in California, you might find valuable insights in the blog post ‘5 Tips On How To Start A Business In California.‘ This resource provides practical advice and guidance for entrepreneurs looking to establish their ventures in the Golden State.